The Implications of the Grayscale Discount

The arrival of institutional investors into Bitcoin has been the game-changer. The last Bitcoin halving was a year ago, and since then, these funds have bought more Bitcoin than the miners have generated. Of all the reasons why Bitcoin has been strong over recent months, institutional demand ranks high on the list.

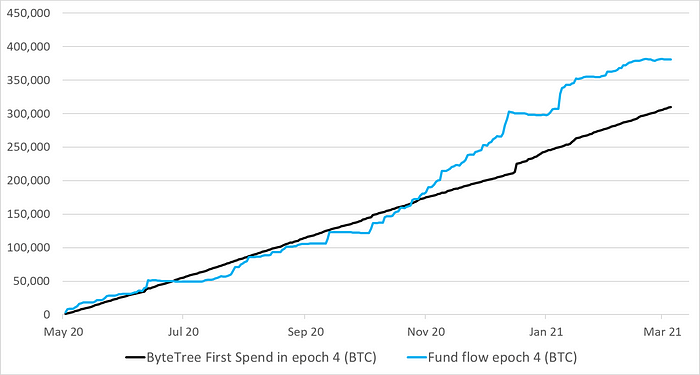

Since the last halving on 12 May 2020, 309,557 BTC have been released into the network by miners, while the institutions have purchased 380,644 BTC. As a result, 71,088 BTC have been acquired from the secondary market.

More buyers than sellers

Bitcoin purists baulk at the idea of funds — so stupid, just get a wallet! That is easy for a private investor to do, but it is impossible for a large or institutional investor. To hold Bitcoin in a personal digital wallet, you need to be blockchain competent and have no need for an audit trail.

For many, this is an unrealistic proposition. Instead, they want to own Bitcoin in the shape of a security that provides legal clarity and integrates with their existing systems. Bitcoiners should not complain because institutional money is big money, and that means “price go up”.

The fund framework

The USA has the largest fund, the Grayscale Bitcoin Trust (GBTC US), which owns circa 646,000 BTC, followed by Sweden, which hosts the two Bitcoin Tracker One funds (COINXBT SS & COINXBE SS) managed by CoinShares, launched pre-2015. CoinShares recently listed in Sweden with an $840 valuation and hold approximately 57,000 BTC.

In late 2018, 21Shares AG (then called Amun) launched a crypto basket ETP (HODL SW), which holds a basket of five coins, which today are; Bitcoin, Polkadot, Ethereum, Cosmos and Stellar. Since then, the issuer has launched 12 different crypto ETPs, including their Bitcoin ETF (ABTC SW), in early 2019. 21Shares has the most diverse range of funds and have grown to $1 billion in assets.

Later in 2019, WisdomTree launched a Bitcoin fund in Switzerland (BTCW SW), followed by VanEck (VBTC GY) and HAN (BTCE GY) in Germany last year. Finally, in Europe, CoinShares Physical (BITC SW) was launched in January. The European ETP landscape for Bitcoin-only funds today hold circa 99,000 BTC, collectively worth $5.5 billion.

North America has also seen new funds on the scene. 3iQ (QBTC-CN) launched a Canadian Bitcoin fund in late 2020, followed by ninepoint (BITC-U CN), Purpose (BTCC/B CN) and Galaxy (BTCG/U CN). Osprey (OBTC) also launched this year in the USA, following the Bitwise 10 Crypto Index Fund (BITW US). The North American Bitcoin-only funds today hold circa 689,000 BTC, collectively worth $38.5 billion.

The grand total for Bitcoin-only funds looks like this.

ByteTree is collecting data on fund flows for online publication. If your fund has not been mentioned, or you would like to ensure a primary data feed, then please do not hesitate to contact us.

ETFs versus closed-ended funds

All of the European Bitcoin funds are exchange-traded products known as ETPs. These are basically ETFs, but traditionally in Europe, when an instrument is complex, it gets a P rather than an F in the description.

With the exception of Purpose, which is akin to an ETF, the North American Funds are closed-ended funds, often known as investment trusts. That means the funds hold a fixed amount of BTC, with a free-floating share price. The share price may be higher or lower than the BTC it represents. When higher, we call this a premium; when lower, a discount.

Example: Grayscale’s GBTC has 692,370,100 shares outstanding, and the fund holds 0.00094632 BTC per share. They, therefore, hold 655,204 BTC on behalf of their shareholders. Yesterday, GBTC shares closed at $49.86, yet the fund was valued at $52.13 per share. That means GBTC shares trade at a 4.3% discount to their net asset value (NAV).

The value of BTC moves around, and there is no formal link between the share price of GBTC and the value of its BTC holdings. If more people want to sell GBTC than buy, the share price will fall, regardless of the Bitcoin price. However, there is an informal link as this data is published, and leaving aside the madness of crowds, investors will be enticed by the discount and steer clear from a premium.

Unfortunately, we cannot leave aside the madness of crowds.

The power of a premium

A premium means investors are prepared to pay more for the exposure to the asset than the assets are worth. They might do that because there is limited choice (no other funds) or just hype (buy Bitcoin). Until recently, GBTC was one of the few ways for US investors to buy Bitcoin via a fund. And there was a dose of hype.

The GBTC premium (or discount) is shown below in grey. Most of the time, GBTC has traded at a premium, and sometimes massively so. There were times in 2017 when GBTC shares traded over twice their fair value.

The Grayscale Premium erodes

You can invest in GBTC directly through the stockmarket. Alternatively, accredited investors can subscribe to the fund at NAV and receive GBTC shares in six months. If the GBTC price is at a premium in six months, you benefit from that.

For example, you call the Grayscale sales team and invest $1 million. Grayscale buys $1m of Bitcoin; wait six months, and you receive your GBTC shares. Assuming the Bitcoin price has not moved and the premium was 50%, you now have $1.5 million. Nice work.

When there was a hefty premium, this was a popular trade. Qualified investors could borrow bitcoin from lending desks at 7% PA and deposit them with Grayscale, hedging their position in the futures markets to capture the premium, less carry cost, six months later. Many investors subscribed to GBTC new share offerings when there was a premium, and when the premium eased, the inflows slowed. 2020 saw record inflows while the premium averaged 30%. The bad news is, that has turned into a discount. More investors want to sell GBTC than buy.

The trouble is, there is nothing in place to prevent the discount from widening further. Grayscale has announced a $250m share purchase, which is great, but it is too small to make a difference within a $33 bn fund. To be taken seriously, they need to pledge to buy back that quantity each week. The way to do that is to sell BTC and buy back GBTC shares for cancellation.

Grayscale’s solution is to launch an ETF that invests in GBTC in a feeder structure of sorts. I am not entirely sure of the benefits, but it does add another layer of fees for investors. When Osprey (OBTC) offers Bitcoin exposure at 0.49% per annum, you might think GBTC would drop their fees down from 2%; they are unrealistically high given the new world of competition.

The importance of GBTC

As I wrote earlier, institutions have purchased 380,644 BTC since last May. Of that total, around 308,446 BTC came via GBTC. That is, 81% of the total institutional flows have come via GBTC, which now trades at a discount. A discount means institutions will no longer subscribe for new shares, which means GBTC will no longer acquire new BTC.

With luck, this is a GBTC problem and does not spread, but I believe it is important for the space to hold its service providers to account. Unless GBTC takes action to close their discount and maintain it, the selling pressure will build, which could morph into a systemic risk.

Exchange Traded Funds solve this problem. With many applications filed, I imagine they will come to market sooner or later. Like the European ETPs, they will trade at NAV, which is what investors want. Their fees will be lower, and all in all, it will be a more attractive package. When they come, the only reason investors will stay in GBTC is capital gains tax.

When the GBTC discount first appeared a few weeks ago, there were cries of buying the dip. I am not so sure, and for the sake of the Bitcoin space, I very much hope they restore investor confidence without delay.

This article was written by Charlie Morris, Co-Founder and Chairman of ByteTree. The article has been cross-posted from ByteTree Insights, originally published on 17th March 2021.

Subscribe to our mailing list for weekly updates. Follow Charlie on Twitter, @AtlasPulse