How Bitcoin Challenges Gold

In an extraordinary week for financial markets, Bitcoin held its ground. For several years I have highlighted the close correlation to risky assets, and tech stocks in particular. Yet for the past few months, I have highlighted how Bitcoin could detach itself from the pack and offer investors an exciting, liquid and uncorrelated asset class.

In the first instance, Bitcoin would have to break away to the upside, and better still, to do it at a time when tech was coming under pressure. That job is now underway. Regular readers know how I cherish the Bitcoin versus NASDAQ chart. The 2020-relative-high has been decisively broken. Unsurprisingly, this is turning heads.

Bitcoins breaks away

Source: Bloomberg. Bitcoin relative to NASDAQ futures past three years.

Although it’s still early days, we can be fairly certain that tech is a bubble, yet Bitcoin isn’t. How ever you measure it, tech is highly valued, and the reopening of the economy will cement 2020 as the year of peak growth. In contrast, Bitcoin is growing rapidly, and I would estimate the trend growth rate to be 86% per annum. The three-year consolidation following the price surge in 2017 is over. Bitcoin has found its feet, and a new bull market is underway. Just as investors flock to gold when they see it outperforming the stock market, I believe Bitcoin will attract capital from tech; and there is plenty of it.

I believe the incubation or experimental stage is behind us. People are beginning to realise that Bitcoin is a proven force, and the big names are coming aboard. They see it as a hard asset, which will one day have similar financial qualities to what gold has today. And the reason they seek an alternative store of value is that they know the tech party has come to an end. Bitcoin has challenged tech and is now challenging gold.

The power of gold

I have studied the gold market since 1999 and have found it fascinating. Along with silver, it has played a central role in monetary systems since the early days of civilisation. That proved particularly useful when communications were poor, money was weighed, and information was exchanged by ship. Exchange rates were fixed to gold, because gold is gold, wherever you are. Gold was the original fintech.

In the 1970s, as the US dollar was forced to devalue against gold, the inflation that followed saw gold surge 27-fold. Investors flocked to gold to protect themselves from devaluation. In 2020, with the monetary system unstable for different reasons, there is a sense that another major debasement is underway. I have no doubt that gold will prove useful, and indeed have a $7,000 price target by 2030. 4x is attractive, but in the 1970s, it was 27x. Gold will be an effective hedge, but Bitcoin has the potential to do so much more.

Bitcoin versus gold

The merits of gold are proven, whereas to many, Bitcoin is still seen as the new kid on the block. With limited supply, Bitcoin was designed to become digital gold. It is secure and robust, yet has the advantage of being able to transact within an instant, all over the world. While shy of 5,000 years of credibility and trust that gold has, the future is bright, as Bitcoin plays catchup.

Assuming there are 200,000 tonnes of gold in the world, worth $1,900 per ounce, gold’s stockpile is worth $12.2 trillion. With just over 18.5 million bitcoins in circulation, and if Bitcoin managed to match the valuation of gold, the Bitcoin price would rise to over $600,000: a 50-fold gain. Better still, I believe gold will rise to $7,000 by 2030, and if that proves to be correct, then the upper Bitcoin target can be raised in proportion.

It is a bullish forecast for sure, but one that is becoming ever more likely. After all, the government debt pile keeps on growing, while the future tax base will struggle to support it. The system will crumble, and investors will flock to alternative stores of value such as gold and Bitcoin. While I would agree Bitcoin has a long way to go to match gold’s credibility, the internet is an unparalleled force for spreading ideas, and this will happen more quickly than many people think.

Building Bitcoin’s credibility

Gold is beautiful, desirable, and inert. It is dense, rare, difficult to extract, and steeped in history. But against that, it is heavy and difficult to physically move. Bitcoin may not be physically beautiful, but has every chance of matching, or exceeding, gold’s financial attributes. Better still, it is easy to move and ripe for a digital age.

The central banks don’t buy gold because it’s pretty. They own it because of its liquidity during times of economic stress. It is widely held, provides collateral and universally acceptance. They also like its long-term qualities as a store of value and low volatility. For Bitcoin to challenge gold, it would have to become more accepted, more liquid and more widely distributed.

According to the World Gold Council, gold trades $145.5 billion per day, which is not dissimilar to the S&P 500. Liquidity in itself has value, as investors are willing to pay more for something they know they can sell when financial markets are in turmoil. Today Bitcoin’s on-chain volume is around $3 billion per day, which has grown from zero in ten years. To challenge gold, Bitcoin liquidity needs to rise 50-fold, and I believe it will.

Gold has a highly credible investor base including the world’s central banks, the mega-rich, established institutions and billions of individuals either through jewellery, ETFs or bullion. Being so widely held builds trust and stability. For Bitcoin ownership, estimates are vague but are thought to be somewhere between 20 and 60 million people. This needs to rise into the billions, and it will because the internet has a great track record in spreading ideas. By 2030, Bitcoin could be as widely distributed as gold is today.

Finally, gold has low volatility, which is important because investors welcome stability. Gold’s volatility is similar to 20-year US treasury bonds, which are deemed to be “risk-free”. Given they are long-duration assets, this is low and has averaged 18% over the years. Bitcoin volatility has historically been off the scale but has calmed. Bitcoin volatility is currently 38% (90-day realised), which is lower than Amazon and Apple. Deeper capital markets and value buyers such as institutional investors and central banks (welcome Iran) will naturally dampen price volatility. Bitcoin will become a highly credible long-duration asset.

More liquidity, wider distribution and lower volatility will all create value and put Bitcoin firmly on the path of matching gold’s success as a store of value. It took gold 5,000 years to get to where it is, but I suspect Bitcoin will be much quicker. Not only will the internet spread the word, but the macroeconomic environment will become a driving force. Bitcoin is challenging gold, and it might even win.

For more information about ByteTree Asset Management please visit bytetreeam.com

Sources:

(1) The long term bull case, Michael Saylor on Bitcoin, Hedgeye TV, 20/10/2020

(2) Bitcoin bull reveals why the digital goldrush is coming, TCNTV 26/10/20

(3) Bitcoin infiltrates corporate America, Real Vision 21/10/20

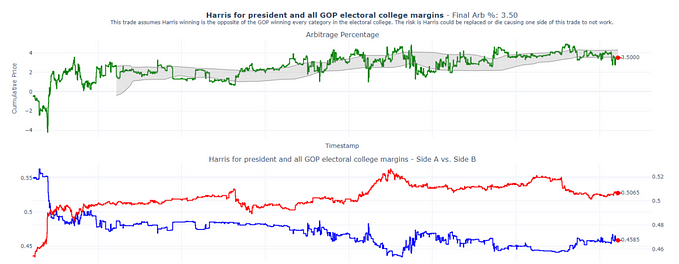

Network Demand Strategy

The market health score has risen to 6 out of 6. Velocity has improved and is back above our revised threshold. Miners’ rolling inventory (MRI) is especially strong, and the on-chain data geeks out there might like this chart. It shows the year on year percent change in inventories held by miners. It is striking how they hold on during bear markets as seen by the lower selling pressure in 2014 and 2018. This has turned down again, which is bullish. I repeat, miner selling is bullish.

Falling inventories is bullish

Source: ByteTree.com. Bitcoin annual change in inventory held by miners since 2013.

This article has been cross-posted from ByteTree Insights, originally published 11th November 2020.

Subscribe to our mailing list to receive the next weekly ByteTree Market Health Update by email. Follow Charlie on Twitter, @AtlasPulse.