Halving boosts the Bitcoin price by 2.3 times — and my $1 million target

In this piece I look at the supply dynamics of Bitcoin and how they impact price. Although supply is generally thought to be predictable, that’s an overstatement, as it’s up to the miners when they decide to sell. I also look at halving and show you that it is more of a process than an event. I then look at velocity and how it relates to supply, to conclude that the four year halving cycle will likely boost the price of Bitcoin by 2.3 times. But hang around until 2045 and there is a good chance that Bitcoins will trade over $1 million each.

Mined bitcoins aren’t necessarily spent

As I write, the total number of Bitcoins mined is 17,682,485, but this overstates the quantity in the network by 1,632,048 coins or 10.1%. There is a widespread assumption that the coins mined immediately join the network, but they don’t have to. They only enter the network once the miner has “spent” them; which more often than not, means they have been sold — or at least distributed into the pools, and then sold.

Blockchains are more than software as they bring computers to life by interacting with human behaviour. 1,816 bitcoins (daily average in 2019) may have be mined each day, but they don’t enter the network until a human decides they want to sell. I feel this is important to understand because it lies at the heart of supply analysis. At ByteTree, we measure the network as being the lower figure, as that is what is actually out there. Most of those 1.6 million unspent coins, may never see the light of day, but if they ever do, you will know immediately because ByteTree tacks them in real time.

The difference can be seen below and it is striking. The orange bars show you what was mined, whereas the blue bars show what was actually spent; something we describe as “first spend”. You can also see the miners’ reward fall in late 2012 and mid 2016; the periods known as halving.

I showed in a recent piece the impact of selling pressure how the market is always balanced. That is, it is expected that the miners are future sellers, and the price of Bitcoin reflects that. The market is used to the idea of absorbing $70 million of Bitcoins each week. That’s a big number.

Buyers and sellers are matched

In a free market, supply must equal demand, with the only variable being price. Too much Bitcoin coming to market? The price must fall until buyers are enticed. A surge of interest from new buyers? The price must rise until holders are tempted to sell. It is important to remind ourselves of this, because it doesn’t matter how strong or weak the market is, whatever the miners sell must be bought by investors.

If the miners all sold their holdings as they were mined, Bitcoin’s volatility would be higher. There would be times when the miners would be selling too much into a weak market, causing mayhem; just as they did in late 2014 and November 2018. But most of the time they have been smart, and have sold more into strength, thus capping rallies, and held back on weakness. It may surprise you to hear, but on balance, the miners have dampened market volatility.

Velocity

Economists look at velocity to see how fast money moves around an economy. It is calculated by comparing GDP (economic activity) by the amount of money in circulation. In the US, it has been falling for years, but since mid 2017, has started to rise. That is because the US economy is now growing faster than the money supply; an environment that normally sees inflation rise.

But economic statistics in the old world are full of mistakes. Velocity in the US may be rising, or falling. No one really knows. With blockchain, we know exactly how things are.

In order to calculate velocity with Bitcoin, the money supply is predetermined because we know the main ingredients of the future supply. That is we know how many Bitcoins are being generated, but not when the miners will spend them. In any event, that’s a lot more predictable than for a traditional economy.

For Bitcoin, the money supply is the number of coins in circulation, and the proxy for GDP is the general level of spend. That is the number of coins whizzing around the network each day — or spend. In order to calculate that, we take the total output volume of Bitcoins transacted and remove the change, thus giving an economic impression of the level of spend. But spend is noisy, particularly in the early days when Bitcoin traded at a very low prices. Nevertheless, by adding a 100 day smoothing (simple moving average) in red, a pattern starts to emerge.

The most recent reading shows a supply of around 16 million bitcoins with just under 300,000 of them changing hands each day. That implies that the Bitcoin network sees its coins turnover around seven times each year. In the US, a dollar moves at a 1.4 times pace, so that brings home how vibrant the Bitcoin economy really is.

There are few observations I would make about Bitcoin velocity:

- It is mean reverting with a long-term average around 770%.

- You would generally associate high readings with hype and low readings with despair.

- Large gains can generally be associated with rising velocity.

- Large losses (2014, 2018) were associated with falling velocity.

- As previously mentioned, Bitcoin halving occurred in late 2012 and mid 2016. Both of these led to periods of high velocity.

- The next halving is expected to occur in May 2020. Prepare for a surge in velocity.

- I have back-tested velocity. By avoiding falling velocity, that reduces risk, but it also misses some gains. This is similar to growth stocks, that can surge even as the economy is slowing.

- I think velocity should be seen as a gauge of health and hype, a bit like the PMIs in the stockmarket.

Halving is a process

The next chart shows you that while halving is an event, its impact is more of a process. The selling pressure doesn’t drop off a cliff, but it rolls downhill over time; albeit with sharper declines during halving periods. The network now sees around 1% of supply sold each quarter.

Halving boosts the intrinsic value by 2.3x

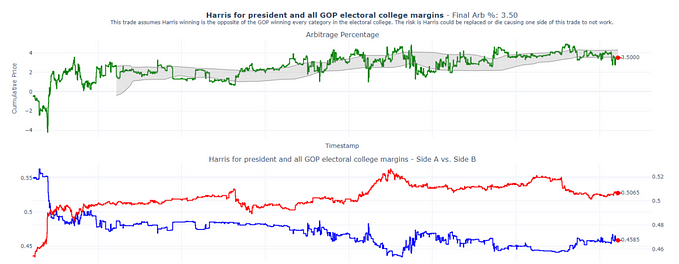

While velocity appears to mean revert around a constant, the next chart says it all. Here I have taken the weekly average velocity (past 12 weeks) and divided it by the change in supply over the same period.

And these are my observations:

- This chart is ascending as velocity revolves around a constant and supply is forever falling.

- Although the early days had questionable data, there are levels between the between halving periods.

- The average reading until the first halving in late 2012 was 211.0%. The next period until mid 2016 saw an average of 535.1%. The average since is 1261.1%.

- These increases between halving periods was 2.4 times and 2.3 times respectively.

Summary

It’s hardly rocket science to say that halving the supply will see the price of goods double. But by looking at actual data, and the unbiased results, it turns out to be a little better than that. The next halving process ought to boost the price of Bitcoin by around 2.3 times.

To recap, we know that coins first spent (sold) by the miners, must be bought by someone. It follows that constant demand will have a positive impact on price when there are fewer coins to sell. 1,800 per day will drift down towards 900, when circa $10 million is queuing up to buy their piece of the action.

Naturally, if no one cared about Bitcoin, and the network was dead, this ratio would still double, but 2.3 times zero is still zero. If you agree that velocity is mean reverting, then the only thing left to give is price. And given that we have two samples, and both have seen halving drive up prices, there is every chance that history will be repeated.

In conclusion, it remains my view, that the most important determinant of the Bitcoin price is the level of spend, or the general level of economic activity within the network. Bitcoin has risen by around 50,000 times since 2010. Just over 5 of those multiples can be attributed from the change in supply. The remaining 10,000 times came from an increase in demand. In any event, expect the fair value of Bitcoin to rise by 2.3 times, plus (or possibly minus) the change in spend.

Thinking along these lines makes me realise that the price targets from the prema-bulls start to look entirely reasonable. It’s simply a matter of how much people will use Bitcoin in the future. But even if the Bitcoin network stands still (unlikely), in 25 years we’ll see seven halvings. So on supply dynamics alone, we’ll see $1 million Bitcoin by the year 2045. Of course, that would mean there’s no mass selling from current holders (unlikely).

Follow the miner spending patterns and many other metrics, please visit https://bytetree.com/. The data set has been under construction since November 2013 (no typo). There’s much more coming that will help you to better understand the value of the crypto using data directly from the blockchain. Caveat Emptor.

Thank you for reading.

Charlie Morris, Founder and CEO