Gold Is 13% Overvalued — Why That’ll Soon Look Cheap

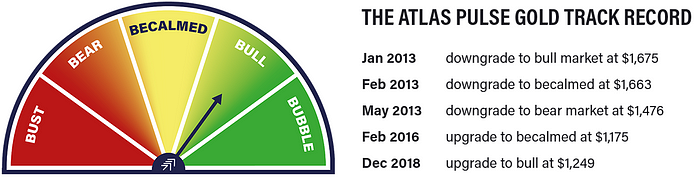

Atlas Pulse Gold Report; Issue 73

Investors are overly fixated on the rise in real rates as the driver of the gold price. They forget the tailwind of inflation and the option value against a change in the outlook.

Highlights

- Macro: Watch out for the next CPI print

- Valuation: 13% dear

- Flows: They are selling gold!

- Technicals: Trend has cooled

MACRO

In 2022, we have seen the 10-year real rate spike from -1% to +0.5%. A lesser move in 2013 caused the gold price to collapse by 30%. What is different this time?

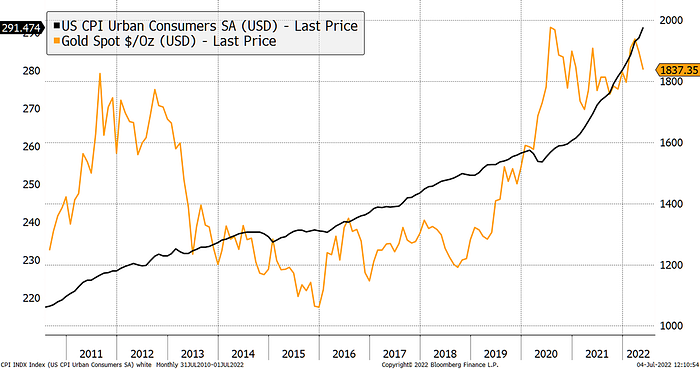

Gold back in line against copper

One big difference is that in the two years up to February 2013, when rates spiked, inflation was 2.5%, and in the two years following, a mere 0.5%. Contrast that with today, where inflation has been 6.8% since June 2020 or 13.3% in total.

2013 to 2016 saw inflation grind to a halt

If a sudden hike in real rates causes gold to fall by 30%, as it did in 2013, then recognise the dollar has debased by 13.3% (total inflation over the past two years), and so nearly half the pain has already been offset by a loss of dollar purchasing power.

Fair value hit by real rate spike

But that is not to say that hikes in real rates aren’t a problem. They are. The fair value of gold has fallen by 28% since the 8 March 2022 peak. Luckily for gold, it was trading cheaply at the start of the year with a 16% discount. Today that is a 13% premium, which is slightly uncomfortable, but with 1% monthly inflation (last month’s CPI), it will be gone by next summer.

Gold back to a premium

A 13% premium isn’t something to lose sleep over. Furthermore, the fundamentals could catch up even sooner if the 20-year breakeven returned to 2.7%, where it was a couple of months ago. That alone would see the 13% premium magically disappear.

Inflation expectations drop to 2.4% per year (it was 1% per month last month)

It’s a mystery why inflation expectations are 2.4% when inflation is closer to 10%. But the Fed has it all in hand, we are told, and the drop in bond yields signals the end of this inflationary mess.

We’ll find out on 13 July at the next CPI print. Market expectations are 1.1% for the month and 8.8% for the year. With bond yields below 3%, these are high numbers to ignore.

State Street has an excellent data set called Price Stats which scrapes thousands of prices from the internet. I had access for years, but alas, I no longer do. Fortunately, they slip the odd chart onto Twitter. They wrote:

“The US PriceStats series is not distorted by re-opening sectors such as used cars or airfares as a result it shows a lower annual inflation. But having initially peaked in March, it is now rising sharply once again in early June, a troubling sign for those hoping the official inflation trend has peaked.”

There are seemingly no signs from the real world that CPI has peaked, just from Wall Street. You have to wonder how 1.1% for the month (which is 14% YoY) magically disappears. I know there’s a recession coming, but still. This is monetary, which is hard to push back into the box.

It all comes back to what should the price of money be? This question has still not been answered. But you’d have to be mad to dump gold at this moment in time.

FLOWS

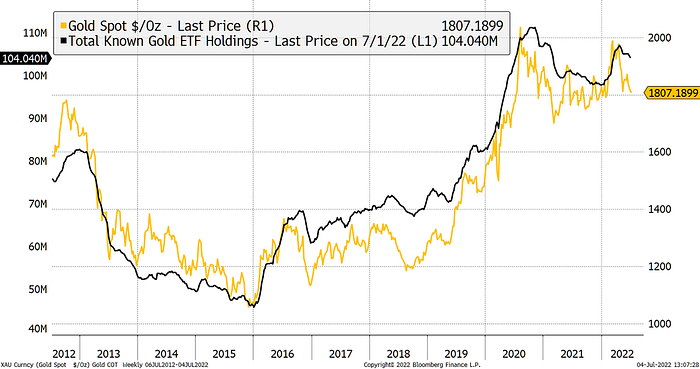

Yet selling gold is what investors have started to do. Historically this has always been late.

Investors sell gold

What I am sure of is that as soon as the trend improves, these sellers will come straight back.

TECHNICALS

That trend is subjective because most people don’t live in the USA, and their gold looks more like this. It is gold x DXY, which strips out the dollar and shows gold in a basket of EUR, JPY, GBP and so on. The chart is not bad at all.

Gold without Dollars

Yet, with the dollar being so strong, that same asset appears soft. It is encouraging, perhaps, that gold has been trading in this zone for two years, so it would be unfortunate if it broke. Especially since the spike in real rates has already happened.

Gold in Dollars

SUMMARY

It is a bizarre old world. The stockmarket has come down from the greatest ever bubble to bubble. It is a long way from cheap. The bond market too. If inflation returns to zero, you could just about buy a government bond that pays 3%. That seems unlikely.

Investors are overly fixated on the rise in real rates as that is all most investors seem to understand about gold. They forget the tailwind of inflation and the option value against a change in the outlook. If inflation hangs around 10%, and the bond market finally notices, then dear old gold will remind investors why they need to own it.

Thank you for reading Atlas Pulse.

If you wish to receive Atlas Pulse, then please subscribe to the ByteTree mailing list.

This article was written by Charlie Morris, Co-Founder and Chief Investment Officer at ByteTree. The article has been cross-posted from our website, originally published on 6th July 2022.

Visit ByteTree Terminal for Bitcoin on-chain data tracked in real-time. We also track Ethereum, Gold, and Silver Fund Flows.

Subscribe to our mailing list for free weekly updates.