Bitcoin Overtakes the FAANGs in 2020

ByteTree Market Health Update; Issue 50

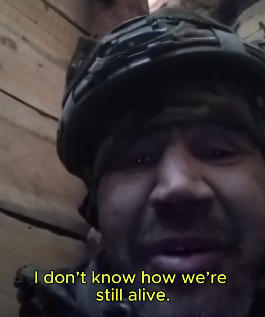

There’s a big election result coming, which will shape the world for a while. In contrast, Bitcoin will change the world forever.

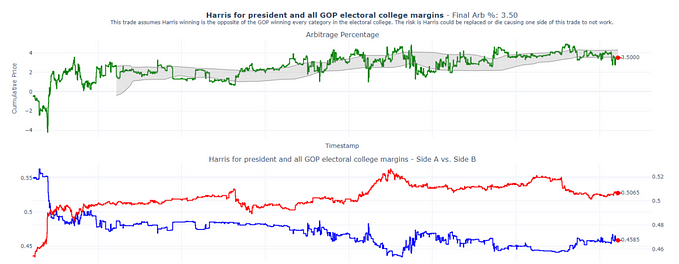

The previous 2016 election did little to affect Bitcoin’s price, however, it seems this election is much closer and will be decided with the “Rust Belt” states. Will Bitcoin become a more attractive asset class because of the economic uncertainty surrounding this election? Most certainly.

Just like every week, it has been another notable week for Bitcoin. Our digital friend has held firm while the FAANGs have run out of steam. The FAANGs have enjoyed a monumental bubble that cannot possibly be sustained on any rational analysis. They are great companies for sure, but their prices reflect their continued success being extrapolated into the mid-century. In contrast, Bitcoin is just getting started.

Bitcoin overtakes the FAANGs in 2020

Remarkably, Bitcoin is now the best performing “asset class” of 2020, and to beat the FAANGs is an impressive achievement. Regular readers will know that the detachment from tech is something I have been anticipating for some time. I highlighted the break ahead of the NASDAQ; a force that is looking increasingly decisive.

Bitcoin leadership over the Nasdaq is convincing

Not only is Bitcoin showing leadership at a time of uncertainty, but it is also doing so with structurally lower volatility than in the past. This is hugely important because Bitcoin has a reputation for being volatile, yet that may be beginning to change. One important indication of asset quality is volatility. The highest quality assets are stable and calm, whereas low-quality assets are volatile. Never underestimate the value attributed to price stability. Billions and billions opt to allocate to less volatile assets.

Looking at the past two years, Bitcoin is demonstrating less volatility than most of the leading tech stocks. Looking at 90-day realised volatility, only Microsoft has lower volatility. For Bitcoin, this is an important development in price stability. Tesla behaves like Bitcoin used to, yet today, Bitcoin is “catching down”, in volatility terms, with the highly credible Microsoft. Bitcoin has recently displayed lower price volatility that Tesla, Netflix, Apple and Facebook. Microsoft is still the daddy.

Bitcoin is less volatile than the FAANGs

The commonly held belief is that Bitcoin is volatile. That was true, and something that is true for any asset in its early stages of life. But as it matures and establishes itself, volatility falls. Using 360-day volatility to calm the results, we can observe longer-term trends back to 1996. At that time, Microsoft was already insanely profitable, while Apple was struggling, and Amazon was a loss-making start-up selling books.

All great assets are volatile in their youth

Sometimes it helps to zoom out and put things into perspective. From 1998 to 2001, Amazon was as volatile as Bitcoin was at its scandalous heights. Apple was close behind. But as Apple turned the corner when Steve Jobs returned and launched the iPod, and as Amazon diversified beyond selling “paper” books, their long-term volatility fell as their asset quality rose. Bitcoin is following that same path, and even taking into account the collapse in March, the long-term investment case is building. Bitcoin’s structural volatility is falling.

The best is yet to come

You might like to hear a refreshing view on Bitcoin by the CEO of ByteTree Asset Management (BTAM), Charlie Erith. He’s the other Charlie, and I have known him for at least 15 years. His background is two, or probably three decades of hard graft in broking Asian equities, followed by a successful stint in fund management. He is brilliant, and I am delighted that he agreed to head up BTAM.

As they say in the space, he’s a NOOB (newbie, newb, nub, or n00b pronounced “new be”- definition: someone who is new to Bitcoin), but don’t hold that against him. NOOBs are converts. I was a conscientious objector in 2011, despite a convincing pitch from a friend, Thomas Paterson. That terrible decision must have cost me at least a private jet, and probably a yacht too. But in 2013, I was converted and proudly became a NOOB. Having not seen Tom for a while, I can only assume he is happily retired in the Tropics.

For Bitcoin to challenge gold, I estimate that the network needs to grow from 60 million holders, who were all once NOOBs, to 3 billion. Celebrate NOOBs, for they are the source of growth. Without them, Bitcoin will remain on the periphery of not only the financial system but everything.

After I converted in 2013, there was a period where I became a massive bore and became obsessed with Bitcoin. I bored my friends, just like a friend tried to bore me in 2011. I even bored the other Charlie for a while, and like most people who do their own research, he too became a fabulous NOOB. Charlie reflects on his epiphany once the penny dropped, please take a read here.

Network Demand Strategy

The network demand strategy score remains at 5 out of 6, which is in line with last week. That points towards a continued bull market.

A final note

Last week I highlighted that despite the bullish consensus view, the on-chain metrics suggested that the Bitcoin price was ahead of events. I am definitely not the type to quash a party, but a short-term price surge remains unlikely, despite the bullish consensus. I reiterate that the price is overbought, and the 5-week NVT (5 wk) remains high. You can read more about that in last week’s post or see the live data on our site.

In other news, Bitcoin fees have exploded while difficulty, the computational effort required to mine Bitcoin, has collapsed by 15%. Difficulty is set by the network every two weeks, and when not enough blocks are mined, it falls.

ByteTree data shows that over the past three months, 6,250 Bitcoins have been mined each week — on average. That has fallen below 5,000 Bitcoins over the past week. That means the miners are not working as hard as they normally do, and by processing fewer blocks, they have caused transaction fees to surge.

That’s a bad thing. When it costs more to transact, people transact less. Investors may keep on chasing the Bitcoin narrative, but the network stalwarts will transact less. I reiterate last week’s message that an imminent surge remains unlikely. But recall, that’s just the short-term message. Our long-term message is no other than bullish.

This article has been cross-posted from ByteTree Insights, originally published 4th November 2020.

Subscribe to our mailing list to receive the next weekly ByteTree Market Health Update by email. Follow Charlie on Twitter, @AtlasPulse.